Trust Administration

At Minter & Pollak, LC, we are dedicated to supporting families through the often overwhelming experience of settling a loved one’s trust. Dealing with a loved one’s trust can be stressful, we are here to help you. The experienced attorneys at Minter & Pollak, LC are here to ensure the legal requirements are met, and to honor your loved one’s wishes.

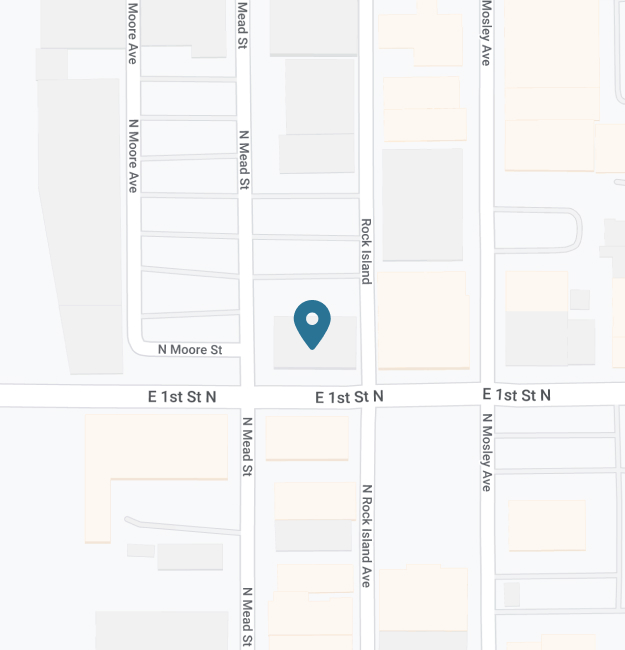

Contact us today at (316) 265-0797 to schedule a free consultation to discuss your Kansas trust administration needs.

The following are some of the steps we can help with in administering a trust.

- Obtain the Trust Documents: Collect all trust documents, including the trust agreement, any amendments, and any related documents such as life insurance policies, real property records or investment statements.

- Identify the Assets: Prepare a comprehensive inventory of the assets held within the trust, including real estate, financial accounts, investments, closely held business interests, and any other valuable property.

- Locate and preserve or probate the Will. If there are any probate assets, the will must be probated. If there are no know probate assets, the will needs to be preserved with the court in case probate assets are located in the future.

- Locate the Beneficiaries: Determine the identity and contact information of all beneficiaries named in the trust agreement. This may involve researching family records, contacting the deceased grantor’s acquaintances, or using social media platforms.

- Engage a Professional Trustee: If the deceased grantor did not appoint a successor trustee, the court will appoint one. This individual will be responsible for managing the trust assets and carrying out the grantor’s wishes.

- Pay Debts and Taxes: The Trustee will need to determine the debts of the decedent and make arrangements for the payment of debts or taxes associated with the deceased grantor’s estate.

- Distribute Assets: Once debts and taxes are taken care of, the trustee may begin distributing assets to the beneficiaries according to the terms of the trust agreement. This may involve transferring ownership of real estate, liquidating investments, or making direct payments to beneficiaries.

- Prepare Trust Accounting: The Trustee must maintain accurate records of all trust transactions, including asset distributions, income generated from investments, and any expenses incurred during the administration process.

Seek Legal Guidance: It is very important to consult with an experienced trust attorney throughout the administration process to stay in compliance with legal requirements and protect the interests of all parties involved. We can help you through this process.

📞 Contact us today at (316) 265-0797 to schedule a free consultation to discuss your Kansas trust administration needs.