- Free Consultation* (316) 265-0797 Tap Here to Call Us

Buy-Sell Agreements: Avoiding Disputes Among Business Partners in Kansas

Why Every Kansas Business Needs a Buy-Sell Agreement

Partnerships and closely held LLCs are popular business structures in Kansas. They allow entrepreneurs to pool resources and share responsibility. But what happens when one owner wants to leave—or worse, passes away suddenly?

Without a clear plan, Kansas businesses can face:

- Disputes among remaining owners and heirs

- Forced sales or unwanted partners

- Costly litigation in Kansas courts

- Even business failure

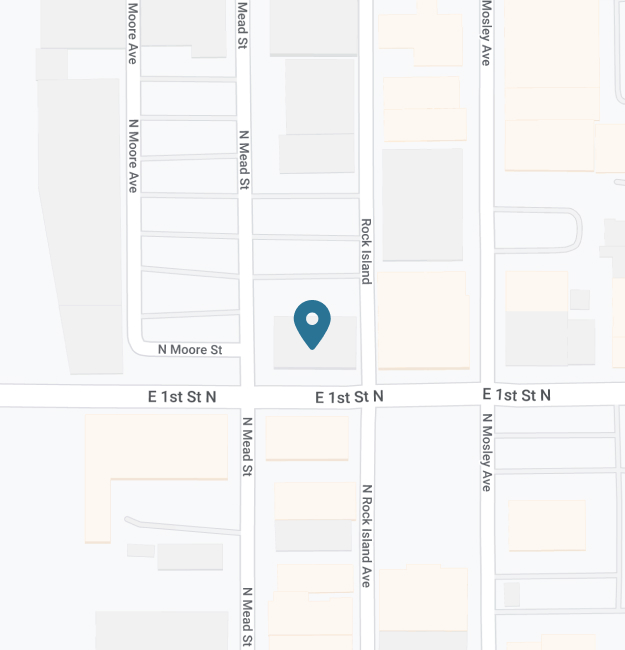

A buy-sell agreement is the solution. At Minter & Pollak, LC, we help business owners in Wichita and across Kansas draft agreements that prevent disputes and protect the future of their companies.

What Is a Buy-Sell Agreement?

A buy-sell agreement is a legally binding contract among business owners that governs:

- What happens to an owner’s interest if they die, retire, become disabled, or want to sell

- Who can buy that interest (remaining owners, the business itself, or outside parties)

- How the value of the ownership interest will be determined

Think of it as a “business prenup.” It prepares the company for inevitable changes in ownership.

Why Buy-Sell Agreements Matter in Kansas

Kansas law gives business owners freedom to contract. But if you do not have a buy-sell agreement, default provisions of the Kansas Revised Uniform Partnership Act or Kansas LLC Act may control. That often means:

- Ownership passes to heirs under Kansas inheritance laws

- Remaining partners are forced to work with people they never chose

- Disputes drag on in probate court

A buy-sell agreement prevents these problems by setting clear, enforceable rules.

Key Provisions in a Kansas Buy-Sell Agreement

1. Triggering Events

Define when the agreement applies, such as:

- Death of a partner

- Disability or incapacity

- Divorce or bankruptcy of an owner

- Voluntary withdrawal or retirement

- Involuntary removal (fraud, misconduct, etc.)

2. Valuation Method

Establish how the business interest will be valued. Common methods in Kansas include:

- Independent appraisal by a CPA

- Formula based on revenue or EBITDA

- Agreed-upon value updated annually

Why It Matters: Without agreement, valuation disputes can spiral into expensive Kansas court battles.

3. Funding the Buyout

Buy-sell agreements often require the purchase of a departing owner’s interest. Options include:

- Life insurance on each owner (funds a buyout at death)

- Installment payments from the business or remaining partners

- Bank financing

Kansas Example: Many Wichita family-owned businesses use cross-purchase life insurance to avoid burdening the company with sudden large buyout costs.

4. Restrictions on Transfers

- Right of first refusal for remaining owners

- Limits on selling to outside parties

- Approval requirements for new partners

This protects the company from unexpected or incompatible new owners.

5. Dispute Resolution

Include mediation or arbitration clauses to avoid lengthy court disputes in Kansas state courts.

Common Mistakes Kansas Businesses Make

- Relying only on handshake agreements. Kansas courts require written contracts for enforceability.

- Failing to update valuation. A business worth $500,000 five years ago may now be worth $2 million.

- Ignoring disability or divorce scenarios. These are common but often overlooked triggers.

- Not funding the agreement. Without financing, a buy-sell is just a promise without a plan.

Case Study: Wichita Partnership Gone Wrong

Two brothers ran a Wichita construction company. One unexpectedly passed away. Without a buy-sell agreement, his ownership share transferred to his spouse under Kansas intestacy law. The surviving brother suddenly found himself in business with his sister-in-law, who had no interest in construction but demanded her share of profits. Litigation followed, draining company funds.

A properly drafted buy-sell agreement could have provided a smooth, pre-funded buyout, protecting both the business and the family.

FAQs About Buy-Sell Agreements in Kansas

Is a buy-sell agreement legally binding in Kansas?

Yes. As long as it is properly drafted and signed, Kansas courts will enforce it.

When should we create a buy-sell agreement?

Ideally at the formation of the business, but it can be added at any time.

Can we change the agreement later?

Yes. Kansas law allows owners to amend agreements if all parties consent.

Do single-member LLCs need a buy-sell agreement?

No, but it becomes essential once there are two or more owners.

Final Thoughts

A buy-sell agreement is one of the best tools to protect your Kansas business from uncertainty and disputes. It ensures continuity, fairness, and financial stability during major transitions.

At Minter & Pollak, LC, we help business owners in Wichita and across Kansas design buy-sell agreements tailored to their goals.

📞 Contact us today at 316-265-0797 to discuss protecting your business with a Kansas buy-sell agreement.

Photo by krakenimages on Unsplash.