- Free Consultation* (316) 265-0797 Tap Here to Call Us

Choosing the Right Business Entity: LLC vs. Corporation vs. Partnership in Kansas

Why Choosing the Right Business Entity Matters

Launching a new business is exciting, but before you serve your first customer or sign your first contract, you need to decide how your business will be structured legally. The entity you choose—whether it’s a limited liability company (LLC), corporation, or partnership—has long-term consequences for taxes, liability, and even how you raise money.

In Kansas, this decision is especially important because state law imposes unique filing requirements, fees, and liability rules. Choosing the wrong structure could expose you to personal liability, cost you more in taxes, or make it harder to bring in investors later.

At Minter & Pollak, LC, we work with Kansas entrepreneurs every day to help them weigh the pros and cons of each option. Below is a breakdown of the most common entity types Kansas business owners consider.

Limited Liability Company (LLC) in Kansas

What It Is

An LLC is one of the most popular entity choices for Kansas small businesses. It blends the liability protection of a corporation with the tax flexibility of a partnership.

Key Advantages

- Personal Liability Protection: Members (owners) are generally not personally responsible for business debts or lawsuits.

- Tax Flexibility: By default, LLCs are taxed as pass-through entities, but they can elect S-Corp or C-Corp taxation.

- Management Flexibility: Kansas LLCs can be member-managed or manager-managed, allowing owners to choose how involved they want to be in day-to-day operations.

- Simple Compliance: Fewer formalities than a corporation, though you must file an annual report with the Kansas Secretary of State.

Potential Drawbacks

- Annual Fees: Kansas requires reports every other year ($100 online filing fee as of 2025).

- Complexity in Multi-Member LLCs: Without an operating agreement, disputes among members can become costly.

Kansas-Specific Filing

To form an LLC in Kansas, you must file Articles of Organization with the Secretary of State. You’ll also want to draft a strong operating agreement, even though the state doesn’t require one.

Best for: Entrepreneurs seeking liability protection with flexible management and tax treatment.

Corporation in Kansas

What It Is

A corporation is a separate legal entity from its owners (shareholders). In Kansas, corporations are often used by businesses planning to scale or seek outside investment.

Key Advantages

- Strong Liability Protection: Shareholders’ personal assets are typically safe.

- Investment Opportunities: Corporations can issue stock, making it easier to raise capital.

- Perpetual Existence: Corporations continue to exist even if ownership changes.

Types of Corporations

- C-Corporation: Subject to double taxation (corporate income tax + shareholder dividends).

- S-Corporation: Avoids double taxation by allowing profits to flow through to shareholders’ personal tax returns. Kansas recognizes the federal S-Corp election.

Potential Drawbacks

- Formalities Required: Corporations must adopt bylaws, issue stock, hold shareholder meetings, and maintain corporate records.

- Higher Costs: More paperwork and legal compliance compared to LLCs.

Kansas-Specific Filing

Forming a corporation in Kansas requires filing Articles of Incorporation with the Secretary of State and paying the filing fee. Annual reports are also required.

Best for: Businesses planning to raise outside capital or scale significantly.

Partnership in Kansas

What It Is

A partnership involves two or more people carrying on a business for profit. Kansas recognizes several types:

- General Partnership (GP): All partners share equally in profits, losses, and liability.

- Limited Partnership (LP): At least one general partner (with unlimited liability) and one or more limited partners (liability limited to their investment).

- Limited Liability Partnership (LLP): Partners have liability protection similar to LLC members.

Key Advantages

- Ease of Formation: A partnership can be created by a simple agreement—no state filing required for general partnerships.

- Pass-Through Taxation: Profits and losses are reported on partners’ personal tax returns.

Potential Drawbacks

- Unlimited Liability in General Partnerships: Partners are personally responsible for business debts.

- Disputes Among Partners: Without a written partnership agreement, Kansas default rules apply—and they may not reflect the partners’ intentions.

- Difficulty Raising Capital: Partnerships generally don’t attract outside investors easily.

Best for: Small businesses with trusted partners willing to share risk and responsibility.

Side-by-Side Comparison

| Feature | LLC | Corporation | Partnership |

|---|---|---|---|

| Liability Protection | Yes | Yes | Only for LLP/LP |

| Taxation | Pass-through (default), S-Corp, or C-Corp | C-Corp (double taxation) or S-Corp (pass-through) | Pass-through |

| Management Flexibility | Very flexible | Rigid (board of directors, officers) | Flexible |

| Ease of Formation | Moderate | More complex | Easy (GP) |

| Best For | Small to mid-sized businesses | Businesses planning to scale or raise capital | Trusted partners in small businesses |

Common Mistakes Kansas Entrepreneurs Make

- Forming the wrong entity for liability protection. Example: Starting a trucking business as a sole proprietor instead of an LLC exposes personal assets in lawsuits.

- Skipping operating or partnership agreements. Even family businesses in Kansas run into disputes without written agreements.

- Assuming tax treatment is the same across entities. A Kansas LLC taxed as an S-Corp can save significantly on self-employment taxes.

FAQs About Business Entities in Kansas

Do I need a lawyer to form an LLC in Kansas?

No, but working with a lawyer helps you avoid mistakes, draft a strong operating agreement, and ensure compliance.

Which business entity pays less in Kansas taxes?

It depends. Kansas does not impose a state-level franchise tax on LLCs or corporations, but tax obligations vary based on your industry and how your business is structured federally.

Can I change my business entity later?

Yes. Conversions are possible in Kansas, but they may involve tax consequences and paperwork. It’s usually easier to start with the right structure.

Final Thoughts

Choosing between an LLC, corporation, or partnership is one of the most important early decisions you’ll make as a Kansas business owner. The right choice depends on your business goals, tax situation, and tolerance for paperwork and formalities.

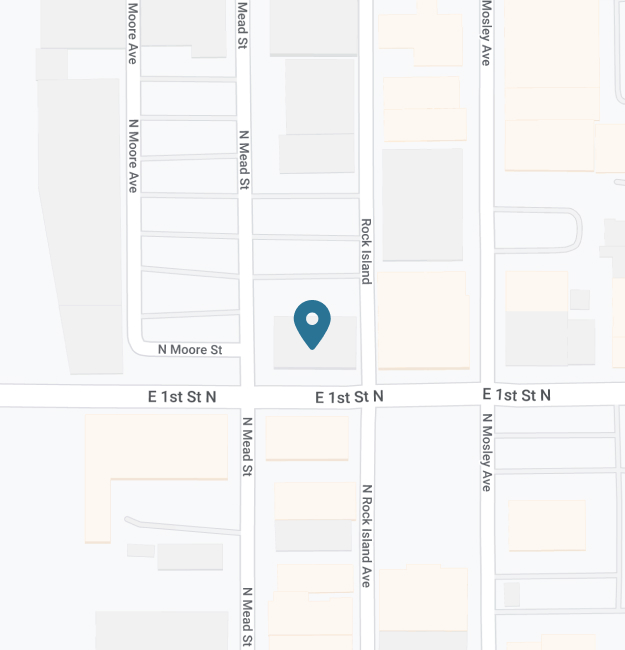

At Minter & Pollak, LC, we help entrepreneurs throughout Wichita and across Kansas weigh their options and set their businesses up for success. If you’re unsure which structure is best, our team can guide you through the decision-making process and handle the filings for you.

📞 Contact us today at 316-265-0797 for a consultation to discuss the best entity for your Kansas business.

Photo by Scott Graham on Unsplash.