- Free Consultation* (316) 265-0797 Tap Here to Call Us

Why Young Adults Need Estate Planning Documents Too

Turning 18 is a major milestone. It marks legal adulthood—and with it comes new rights, responsibilities, and independence. While most young adults aren’t thinking about estate planning, having a few key legal documents in place can be critically important in the event of an emergency.

At Minter & Pollak, LC, we help families and young adults understand what legal protections are necessary once a child becomes an adult under the law.

Here are the essential estate planning documents every 18-year-old should consider.

1. Durable Power of Attorney

Once an individual turns 18, their parents no longer have legal authority to manage their finances. A Durable Power of Attorney allows a trusted person—usually a parent or guardian—to:

- Handle bank accounts

- Pay bills

- Sign documents

- Manage financial matters on their behalf in case of incapacity

Without this, even helping with something as simple as a landlord issue or financial aid form may become impossible.

2. Health Care Proxy (Medical Power of Attorney)

If a medical emergency occurs, parents do not automatically have the legal right to make healthcare decisions or even receive updates once their child is an adult.

A Health Care Proxy, also known as a Medical Power of Attorney, allows a trusted individual to make medical decisions if the young adult becomes incapacitated.

This is especially important if the 18-year-old is:

- Away at college

- No longer in regular contact with parents allowing them to choose who makes these decisions

- Involved in a serious accident or medical event

3. HIPAA Authorization

The Health Insurance Portability and Accountability Act (HIPAA) protects the privacy of medical information. Without a HIPAA release form, even parents can be denied access to health records or treatment updates in a crisis.

This form ensures that designated individuals—like parents or guardians—can receive timely medical information when it’s needed most.

4. FERPA Release

The Family Educational Rights and Privacy Act (FERPA) protects the privacy of educational records. Once a student turns 18, parents no longer have automatic access to their grades, enrollment status, or disciplinary records—even if they’re paying tuition.

A FERPA release allows the student to grant access to their:

- Academic records

- Financial aid information

- Communication with school officials

This is especially useful in emergencies or when parents assist with academic or administrative issues.

5. Living Will

A Living Will outlines a person’s preferences for end-of-life medical care, such as whether they want:

- Life support

- Feeding tubes

- Artificial hydration

- Palliative or comfort care

This document provides clarity and prevents confusion or conflict among family members during difficult medical decisions.

6. Simple Will

While most 18-year-olds don’t have significant assets, they may still have:

- A car or bank account

- Personal items or collections

- Digital assets or cryptocurrency

- Social media or cloud storage accounts

A Will allows them to designate:

- Beneficiaries for their belongings

- An executor to manage their estate

- Instructions for digital assets

Even a basic will can make a big difference in an unexpected situation.

Why These Documents Matter

Without these estate planning documents in place:

- Parents may not be able to help their adult children in emergencies

- Access to medical, financial, or educational records may be denied

- Decisions may fall to default legal rules, not the individual’s preferences

Taking the time to prepare now ensures that someone the young adult trusts is legally empowered to act if needed. It also provides peace of mind to both the young adult and their family.

Estate Planning Is Not Just for Older Adults

Estate planning is often seen as something for married couples or retirees—but it’s just as important for young adults. As soon as a person turns 18, they are legally responsible for themselves. A few simple documents can protect their interests and make life easier for everyone involved.

Schedule a Free Estate Planning Consultation

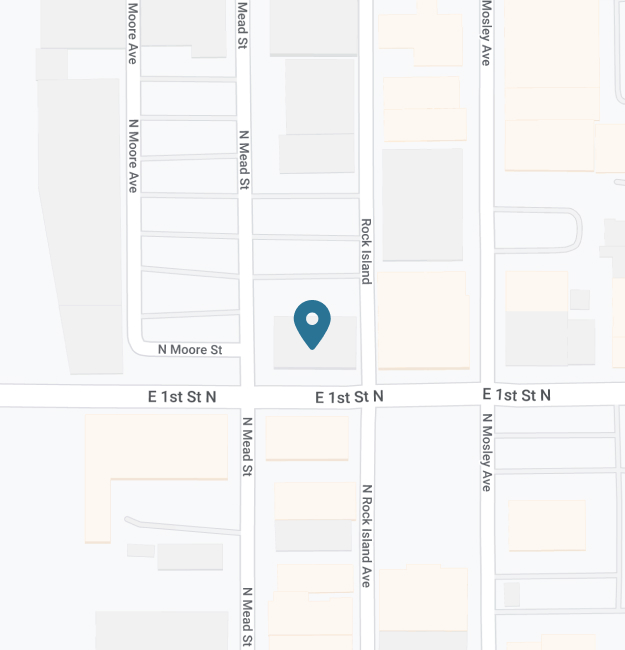

If your child has recently turned 18—or is heading off to college—now is the perfect time to create these essential estate planning documents.

The attorneys at Minter & Pollak, LC can help you get these documents in place for you or your child. We provide free consultations and can be reached at 316-265-0797 or you can set up an appointment through our website with this link.